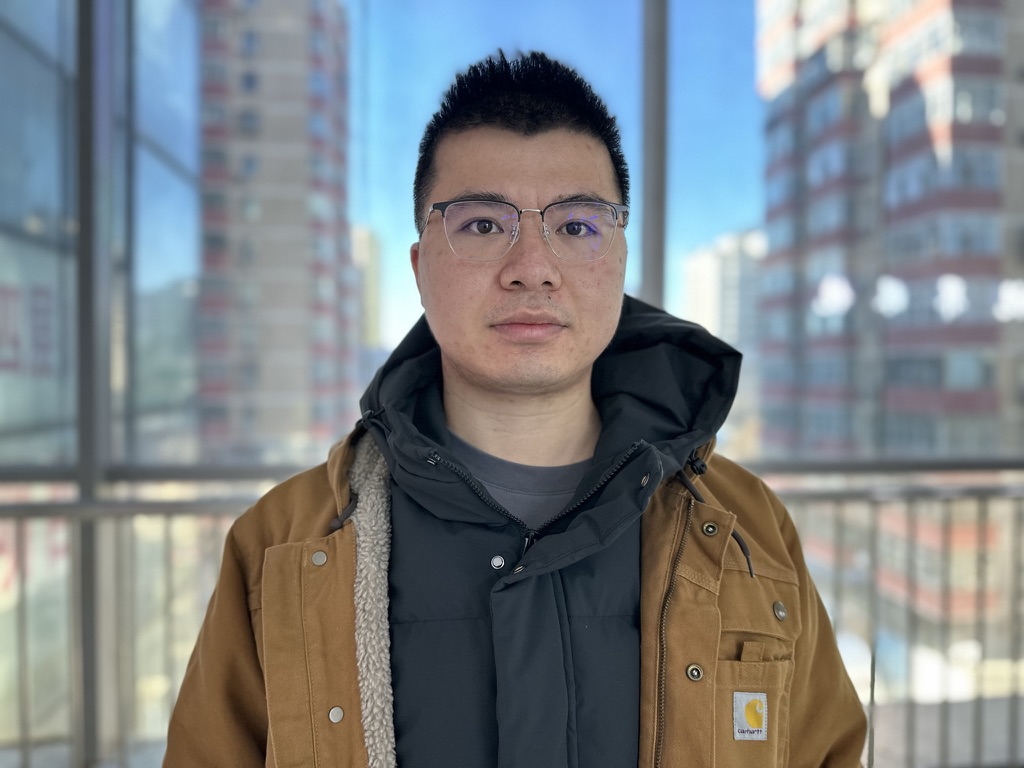

Qihong Ruan 阮启宏

Founder, Agentic Sciences, San Francisco Bay Area

I am currently a Founder in the San Francisco Bay Area.

Previously, I earned my PhD from the Department of Economics in the College of Arts and Sciences at Cornell University, where I studied Economics, Finance, and AI.